- 2 Minutes to read

- Contributors

- Print

- DarkLight

- PDF

Bad Debt (Write Off)

- 2 Minutes to read

- Contributors

- Print

- DarkLight

- PDF

About Bad Debt (Write Off)

Bad debt represents accounts receivables the institution no longer expects to collect. Institutions "write off" this amount as expected revenue. This article specifically covers bad debt as it relates to student charges (e.g. tuition not expected to be paid.)

Depending on the institution's accounting practices, there are two methods to account for bad debt in Campus Cafe: an offset transaction or an Old Account Code notation.

Offset Transaction

An offset transaction zeros the student's balance and is typically charged to the bad debt general ledger account. If this method is employed, the student's balance will be zero, Campus Cafe reports will show the student with a zero balance and the bad debt amount will not appear as an accounts receivable. Reports that sum by transaction code may be utilized to identify write off totals.

If a student with bad debt recorded using this method later makes a payment, the offset transaction will need to be reversed to apply the payment. If not, the student will appear to have a negative balance and be due a refund.

Prerequisite

Before applying an offset transaction create a transaction code (Student Financials > Transaction Codes) to capture all outstanding student balances not expected to be collected.

Apply Transaction Code

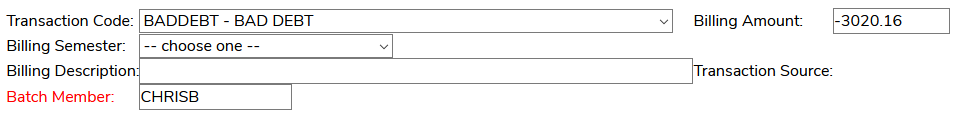

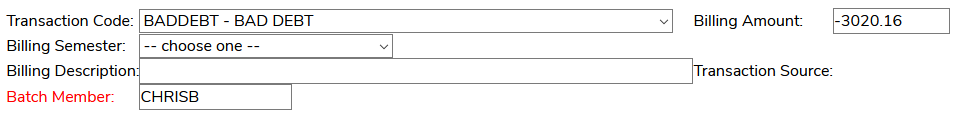

- Navigate to the student

- Navigate to Main Menu > Person Selected > A/R-Ledger Card

- Click Add Bill Batch

- In the Transaction Code box select that code corresponding to bad debt

- In the Billing Amount box enter the noncollectable balance as a negative number

- In the Billing Semester box optionally choose a semester

- Click Save

- The transaction appears in Bill Batch for posting to the student's ledger

Old Account Code Notation

An Old Account Code notation indicates to the system the balance is not expected to be collected but preserves the student's balance. Select Campus Cafe reports, including the Accounts and Receivable Trial Balance and the AR Trial Balance - Summary report, will allow the exclusion of students with an old account notation and/or segregate students with the code.

Institutions may define multiple Old Account Codes (e.g. collections firm A, collections firm B, write off day program, write off evening program, etc.)

If a student with an Old Account Code notation makes a payment, the student's outstanding balance will decrease by that amount. The school's business processes will determine whether the Old Account Code notation remains or is removed.

Prerequisite

Before applying an Old Account Code establish Old Account Codes using STParm SMODCD (Admin > STParm Maintenance).

Apply Old Account Code

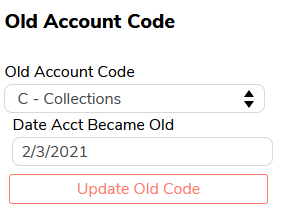

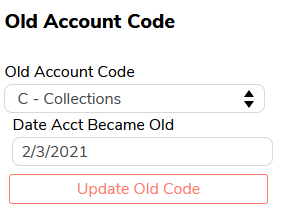

- Navigate to the student

- Navigate to Main Menu > Person Selected > A/R-Ledger Card

- In the Old Account Code drop down select the desired code

- In the Date Acct Became Old enter the date the account became noncollectable

- Click Update Old Code